Submitted by Peoples Bank Wealth Management Group

For prepared investors, market downturns can represent great opportunity

Nearly everywhere you turn, from friends and colleagues to cable news shows, you can find someone with a strong opinion about the financial markets. People will often use specific terms such as correction or bear market to render judgments about the direction of markets, especially when market performance is choppy or trending down.

Is it worth getting concerned when markets stop or even reverse their upward advance?

Typical investors, in all markets, endure many of them during their lifetimes.

your strategy.

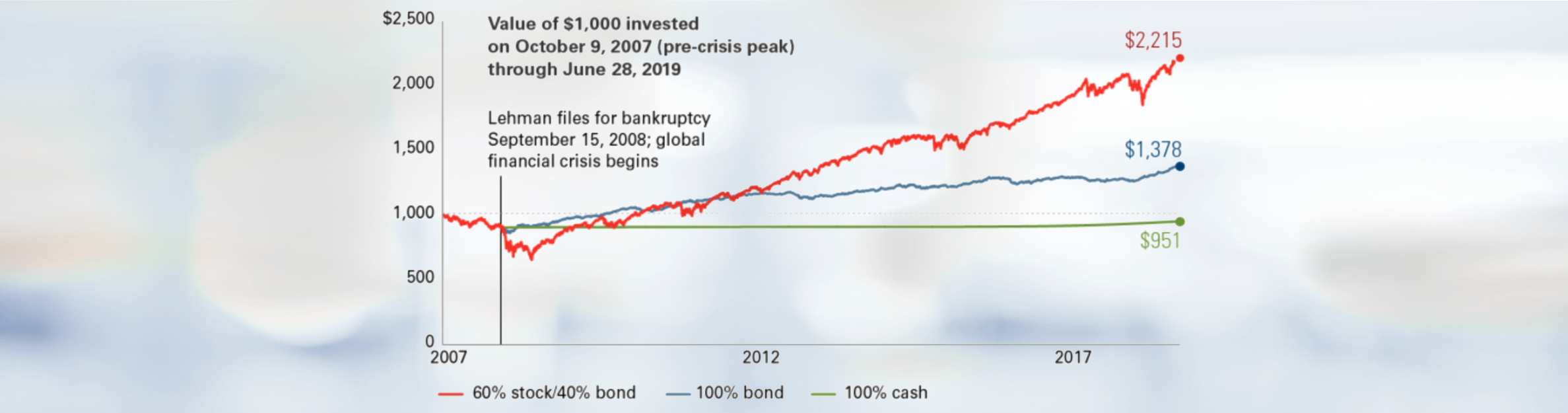

It’s worth noting that not all financial declines are the same in length or severity—for example, historically speaking, the global financial crisis and Great Recession of 2008–2009 was an extreme anomaly. As challenging as that event was, it was followed by the longest stock market recovery in U.S. history.¹

Riding Out a Rough Period

Notes: This is a hypothetical illustration. Balanced portfolio is represented by 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index; bonds are represented by Bloomberg Barclays U.S. Aggregate Bond Index; and cash is represented by Bloomberg Barclays U.S. 3-Month Treasury Bellwether Index.

Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

1 Lu Wang, “The Bull Market Almost No One Saw Coming,” Bloomberg Businessweek, December 15, 2019, https://www.bloomberg.com/news/articles/2019-12-15/the-bullmarket-almost-no-one-saw-coming, accessed on December 19, 2019.

Best defense: Making a plan and sticking to it

In coming up with the best plan for you, it is helpful for you to think about the following:

- How do you feel about risk? Are you OK with a greater amount of up-and-down movement in your portfolio if it means potentially higher returns? Or, alternatively, would you rather have more stability in your portfolio even if it means forgoing higher returns?

- Where are you along your investing journey? Depending on how close you are to retirement or other financial goals, we can adjust your portfolio’s risk profile to a level appropriate for your personal risk-comfort level and investing objectives.

Questions?

This material is for informational purposes only. The views, comments and opinions are based upon current market conditions and are subject to change. This information is not to be considered research, recommendation to take any action or advice from Peoples Bank or any of its officers, directors or employees. Any forecasts, figures, opinions or investment techniques or strategies contained herein are for informational purposes only. This does not include sufficient information to support any investment decision. Investors should visit with their own professional advisers to determine suitable investment actions to take regarding personal goals and objectives. It should be noted that investments involve risk including the possible loss of principal. Investment products are not FDIC insured, not a bank deposit, not guaranteed by the bank or any U.S. Government Agency and principal may lose value. Investment and the income from them may fluctuate in accordance with various market conditions. Past performance is not to be considered an indication of future results.