Investment Outlook For 2023

As a new year dawns, the big question on everyone’s mind, from economists and investors to small businesses and consumers, is where our current economic path might lead. From rising unemployment, cooling inflation, and declining GDP growth, these concerns are front and center in any conversation about the best possible economic outcomes for 2023. While no stock market predictions are ever set in stone, here are some factors to consider that will help define the State of the Markets in 2023.

Are We Heading into a Recession?

Lots of people are asking this question, but no one has a clear answer. You will find a wide range of opinions and predictions. But the fact of the matter is that we don’t exactly know what’s in store. However, we can use historical data to gain insight on what happens during a recession and what may be in store in 2023.

What is a Recession?

In simple terms, a recession is a general slowdown in economic activity with a common rule of thumb being two consecutive quarters of declining GDP. Officially a recession is declared by the National Bureau of Economic Research (NBER) and they look at a variety of factors including:

- Gross Domestic Product (GDP): A negative (declining) GDP reflects a decrease in productivity

- Real Income: A decline in personal income (adjusted for inflation) means less purchasing power for consumers

- Manufacturing: A healthy manufacturing sector indicates a strong economy and vice versa

- Wholesale/Retail: Sales numbers are used to gauge the market performance as well as the health of the consumer

- Employment: High unemployment is a bad sign for the economy as companies tend to have layoffs during periods of economic uncertainty.

Stock Market Forecast

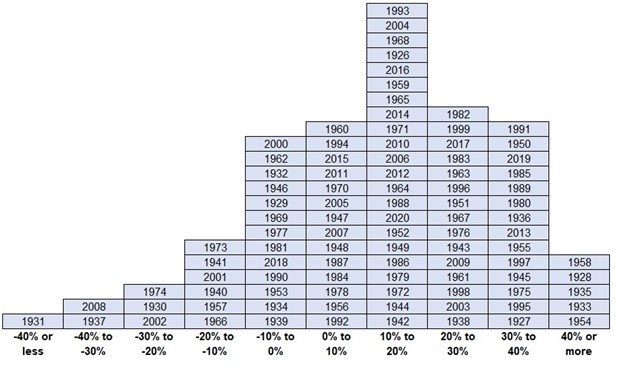

The average annual return for the S&P 500 from 1926-2020 is 10% per year. However, the keyword here is “average.” Investors cannot count on a stable annual rate of return.

As you can see from the chart below, the highest bucket of returns over 95 years is between 10-20%. However, it’s also worth noting that there have been just as many yearly returns above 40% as returns in the 0% to 10% range.

Source: Stock Market Returns Are Anything But Average (awealthofcommonsense.com)

2023 is looking cautiously optimistic with many stock market forecasts for 2023 call for moderate improvements. UBS targets a year-end 2023 S&P 500 at 3900 and KKR sees it at 4150. CFRA expects a 2.9% gain, which would put the S&P over 3900. The S&P 500 closed 2022 at approximately 3840. But a new year brings new hope, new opportunities, and of course, new prognostications. From the look on the horizon, it wouldn't be a surprise to see the U.S. economy dip into a recession this year.

One signal would be the inversion of the yield curve, which can signal a recession is on the horizon; however, not every inversion of the yield curve is followed by a recession. It is important to remember that Wall Street and investors tend to be forward looking. So, while the economy may be entering a recession in 2023, the stock market as well as the yield curve may start looking past that towards a period of economic recovery. This may result in the yield curve inversion correcting itself in the ladder half of 2023.

Equity Outlook

Keep in mind:

- An environment of heightened uncertainty favors companies with records of stability, defensiveness, and secular growth.

- While the United States has high inflation, it has still been much lower than other areas of the world. Combine that with unemployment levels that are still relatively low indicates that any recession the United States enters may be fairly mild. As the economic situation improves as we navigate 2023, we may see some slight improvement in the equity markets.

- There are a lot of uncertainties starting out in 2023 and we will still need additional clarify on inflation and the monetary policy tightening.

Labor Market Forecast: Can We Cool the Overheating?

The labor market has been a major factor in inflation as it stayed hot through the majority of 2022. Unemployment fell to 3.6% in March of 2022 and despite layoffs in the tech sector following rising interest rates, unemployment has remained relatively low during 2022.

As rising interest rates and economic uncertainty continue, we may continue to see rising unemployment. While rising unemployment is challenging for those individuals and families that are affected, rising unemployment does help to slow the economy and helps reduce some of the affects of inflation.

Fixed Income Outlook

The last two months of data has really shown inflation moderating. This would lend us to believe that the Federal Reserve could pause rate increases (or potentially make them decline in the ladder part of 2023 or early 2024) which would either help lift the country out of a recession or reduce the severity. As the Federal Reserve pauses or reverses course on its current rate hiking trajectory, some factors that will impact the fixed income outlook include:

- The immediate pressure on commodity and food prices has eased, which is helping lead to a moderation of inflation. In addition, the desired tightening of financial conditions from the Fed’s intervention on interest rates is working towards bring inflation down.

- While the yield curve is currently inverted as the Federal Reserve either pauses or reverses course, we may see the yield curve start to shift back to normal with short-term yields starting to decline and long-term yields rising or remaining stable.

- The current higher yield environment is allowing fixed income investors the opportunity to purchase bonds with yields that are finally attractive. Due to this, there is cautious optimism that the below-investment grade market is stable. Investment-grade taxable and municipal bonds may offer considerable value to investors.

.png)

Meet Our Wealth Management Team!

It’s normal to feel anxious about your financial future. Gain peace of mind by sitting down with one of our advisors from Peoples Bank Wealth Management Group. We can review your current investment strategy and portfolio of stocks, bonds, and mutual funds to make any necessary changes to better support your long-term financial goals. Learn more about Investment Services and contact us today!

Check out our related blog post on “How To Start Your Retirement Plan.”

Investment products are not FDIC insured, not a bank deposit, not guaranteed by the bank or any US Government Agency and principal may lose value.